Article Updated: 7/11/2018

The oil and gas company told me to sign the lease or they would ‘force pool’ me. Can they do that?

Yes, but it’s not as bad as it sounds. The term ‘forced pooling’ is slang for Colorado statute CRS § 34-60-116(6) that allows the oil and gas company to apply for a pooling order to ‘force’ mineral owners to accept their just and equitable share of production. However, mineral owners should not confuse the forced pooling process with the notion that they are not entitled to some form of compensation.

An oil and gas company representative, known as a landman, is often tasked with “leasing up” a large number of mineral owners in a short period of time. Some impatient landmen will tell mineral owners to “sign the lease now or else the company will just force pool you.” Such an ultimatum sounds foreboding, so mineral owners who don’t understand the process often sign the lease hastily to avoid confrontation. But what is ‘forced pooling’ and what does it really mean for a mineral owner? This article explains ‘forced pooling’ process in Colorado and illustrates a mineral owner’s rights in the event their interest is actually ‘force pooled.’

What is forced pooling?

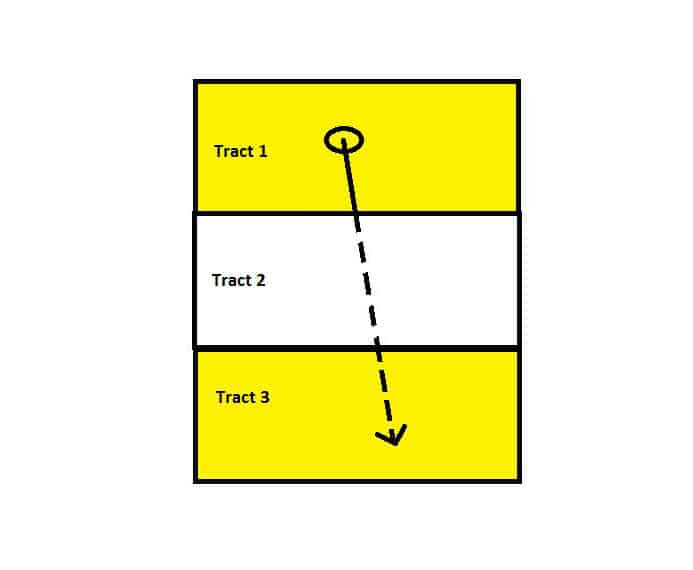

Before delving into the intricacies of forced pooling, it is helpful to first understand the general concept of pooling. Pooling is the comingling of small tracts or fractional mineral interests into a “drilling unit” in order to drill a well. If all mineral owners in a drilling unit sign a lease that includes a pooling provision, then each mineral owner will receive a royalty payment equal to their lease royalty percentage multiplied by their proportionate share of the drilling unit acreage. Many oil and gas leases grant the company the right to pool the owner’s interest into a production unit – this is known as voluntary pooling. ‘Forced pooling’ occurs when the company cannot voluntarily pool the necessary tracts or mineral interests to drill the well, so the company utilizes Colorado statutory law to obtain pooling consent.[1] In such a situation, the company applies to a state agency known as the Colorado Oil and Gas Conservation Commission (the “COGCC”) for a pooling order. The public policy behind statutory pooling is best illustrated by the diagram of three contiguous 100 acre tracts below:

In this illustration, the company possesses a lease on Tract 1 and Tract 3, but not Tract 2. The company would like to obtain a lease with voluntary pooling from the owner of Tract 2, so it can drill a horizontal well from Tract 1 through all three tracts (as shown by the black line and arrow). If the company possesses a lease on Tract 1 and Tract 3, but not Tract 2, then it cannot drill from Tract 1, through Tract 2, to produce the minerals underneath Tract 3. Faced with an unwilling Tract 2 owner and absent a statutory pooling mechanism, the company would most likely drill multiple vertical wells on Tract 1 then even more vertical wells on Tract 3 to maximize development under its Tract 1 and Tract 3 leases. In such a scenario, each additional vertical well would necessitate its own area of surface disturbance. Statutory pooling allows the company to ‘force’ Tract 2 into the pool so it can efficiently produce the minerals under all three tracts without incurring unnecessary costs, stranding finite natural resources, or causing additional surface disturbance. If the Tract 2 owner decides not to sign the lease, then it can decide to participate or not participate in the well prior to being force pooled. If the Tract 2 owner refuses to pool, then the company must apply for a statutory pooling order from the COGCC to drill through and produce from all three tracts.

What are my options if my mineral interest is included in a statutory pooling order application?

It’s not the end of the world if you’re involved in a statutory pooling order application. Colorado statute requires that each owner be tendered a reasonable offer to lease as well as estimated costs to drill the well. Practically speaking, the company will satisfy the statutory requirements by mailing out well proposals. A well proposal typically contains three options:

1. Sign a lease

The well proposal will usually contain an offer to lease complete with terms and a form of lease. If the Tract 2 owner deems the offer reasonable, then it may sign the included lease along with the associated documents and return it to the company. If the Tract 2 owner signs a lease before the COGCC issues a pooling order, it is not ‘force pooled.’

If, however, the Tract 2 owner does not believe the lease offer is reasonable, then it may file a formal protest at least 14 business days before the hearing pursuant to COGCC Rule 509. Upon receipt of a valid protest, the COGCC will hold a hearing to determine reasonableness of the offer based on the terms of the leases already included in the drilling unit. Our attorneys can help you determine if your offer is reasonable and, if not, can guide you through the COGCC hearing to ensure you get a fair deal.

2. Participate in the well.

A mineral owner with the adequate financial means and a requisite risk tolerance might desire to go through the statutory pooling process to participate in the well. Assume the company applies for a pooling order covering all three tracts in the illustration above. If the owner of Tract 2 has 100 mineral acres in a 300 acre drilling unit, it owns a 1/3rd proportionate share of the unit. If it timely notifies the company that it will participate in the well, then it is responsible for 1/3rd of the costs to drill and operate the well. In exchange for fulfillment of his ongoing cost obligation, the owner is entitled to a true 1/3rd of the production from that well for its entire productive life.[2] If the Tract 2 owner elects to participate in the well, it is not ‘force pooled.’ A sophisticated mineral owner that owns a large proportionate share of the unit should consider contacting an attorney at this office to assist with the process of formally participating in the drilling of the well.

3. Elect to be a ‘nonconsenting owner.’

As a third option, the Tract 2 owner may affirmatively elect to not participate in the well prior to the hearing. If the Tract 2 owner affirmatively elects to become a nonconsenting owner, then its relationship with the company is governed by a separate contract. Each separate contract is different, but generally speaking, the rules governing the relationship are similar to those discussed immediately below. An owner that affirmatively elects to become a nonconsenting owner is not ‘force pooled.’

At what point am I actually ‘force pooled?’

If the Tract 2 owner does not timely choose any of the above three options and once the COGCC approves the order, only then is it officially ‘force pooled.’ At this point, Colorado statute dictates that the Tract 2 owner is entitled to a 1/8th royalty payment on the its proportionate share of the drilling unit[3] until the well satisfies certain monetary ‘penalties.’[4] Once the revenue from the well meets the statutorily prescribed penalties , the owner will receive their true proportionate share of production and be responsible for its proportionate share of costs, just as if it participated in the well.

The biggest risk with being force pooled is the uncertainty of the unknown. A well could satisfy the non-consent penalty within a year and continue to operate with minimal additional costs. Conversely, the well might not be as productive and could be riddled with additional maintenance costs. A mineral owner involved in a pooling order application should contact an experienced oil and gas attorney to determine whether the ‘non-consent’ option makes sense given all the facts and circumstances of the specific scenario.

Summary

Mineral owners propositioned with a ‘forced pooling’ threat should not confuse the process to mean ‘no net benefit.’ Colorado law provides owners with rights even if the owner is ‘forced’ into a production unit as a non-consenting owner. An owner involved in the forced pooling process should decide on a path forward based on their individual circumstances. Amount of land, likelihood of a productive well, individual financial situation, and risk tolerance are all factors an owner should consider when deciding how to proceed. If a landman has insinuated the oil and gas company could file a pooling order application or you receive a notification of a hearing, please contact this law firm to discuss your situation and determine the best option for you and your family.

[1] ‘Forced pooling’ is also referred to as ‘involuntary pooling’ or ‘statutory pooling.’

[2] That is, a true 1/3rd interest in the production not diluted by a royalty percentage. Compare Owner 2’s right to 1/3rd of production as a participant with the right to a diluted 4.17% of production as a non-consenting owner discussed in footnote 3 below.

[3] In the example above, the owner of Tract 2 would receive 4.17% of production (being (1/3) divided by 8) until all non-consent penalties are satisfied.

[4] The monetary penalties, collectively referred to as a “non-consent penalty,” include the owner’s proportionate share of off-site equipment and operating costs as well as double the owner’s proportionate share of the cost to drill the well.